With the beginning of the full-scale war initiated by Russia in Ukraine and a global context of uncertainty, investment insurance has become an essential issue for all investors worldwide.

One of the options that ensure certain protection is MIGA Insurance.

MIGA (Multilateral Investment Guarantee Agency Insurance) is an international agency providing investment insurance against non-commercial risks in developing countries.

Leopolis team has prepared an extensive guide about the key things that explain the policy of MIGA, the detailed algorithm of issuing guarantees, eligible countries, investments, and claims resolution.

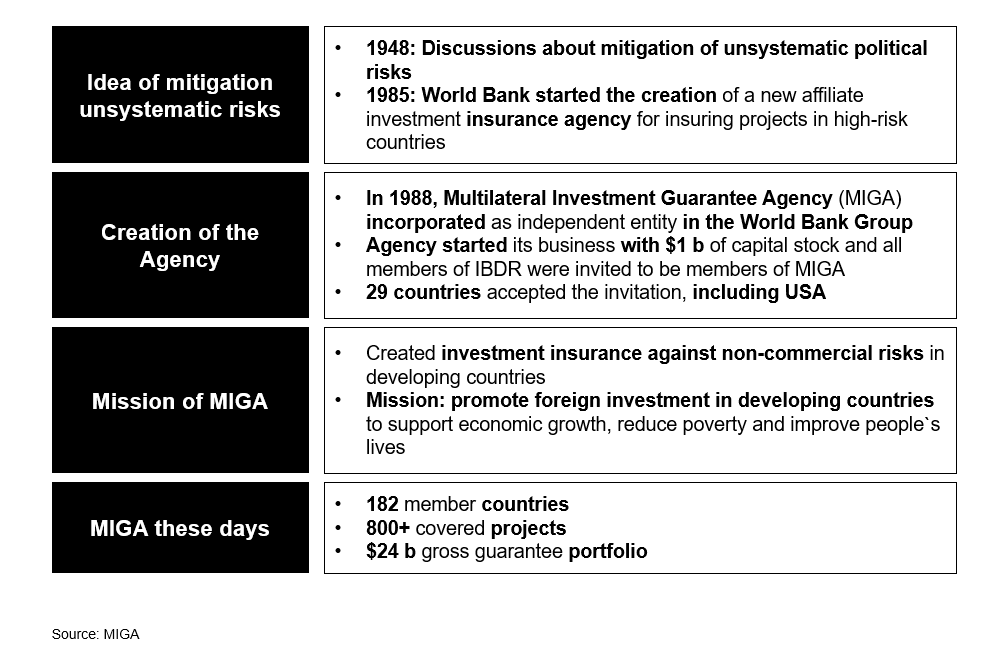

The first idea of mitigation of political risks appeared in 1948 when global discussions about the mitigation of unsystematic political risks started. It did not have a substantial concept until 1985 when the World Bank started the creation of a new affiliate investment insurance agency for insuring projects in high-risk countries.

Finally, in 1988, Multilateral Investment Guarantee Agency (MIGA) was incorporated as an independent entity in the World Bank Group. The agency started its business with $1 b of capital stock, and all members of IBDR were invited to be members of MIGA. 29 countries accepted the invitation, including the USA.

The mission of MIGA includes four directions:

Today, MIGA includes 182 member countries, has a history of 800+ covered projects, and possesses a $24 b gross guarantee portfolio.

In March 2022, after the beginning of the full-scale invasion of Russia in Ukraine, the talks started about the possibility of addressing MIGA to attract certain insurance to cover the losses.

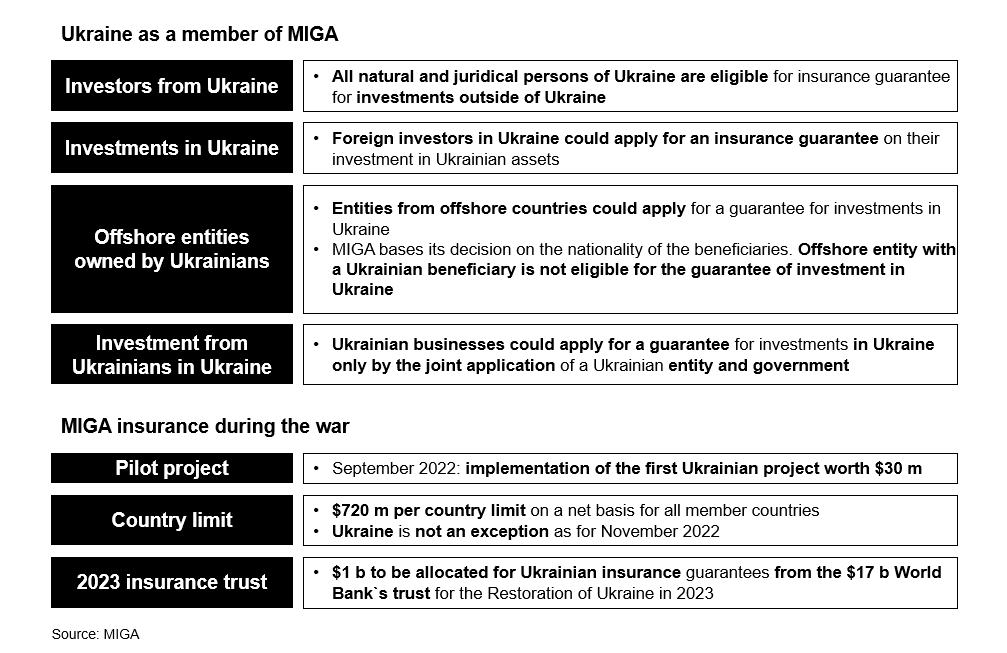

Ukraine has been a member of MIGA since (1992). Therefore, all natural and legal persons in Ukraine are eligible for insurance guarantees for investments outside of Ukraine.

But there are certain limitations to foreign elements in this matter.

There are a few things worth mentioning regarding the involvement of MIGA during Russia's invasion of Ukraine.

There is a limit established for all member countries: not more than $720 m can be issued per country on a net basis for the total portfolio.

But we have some good news for current and potential investors in Ukraine.

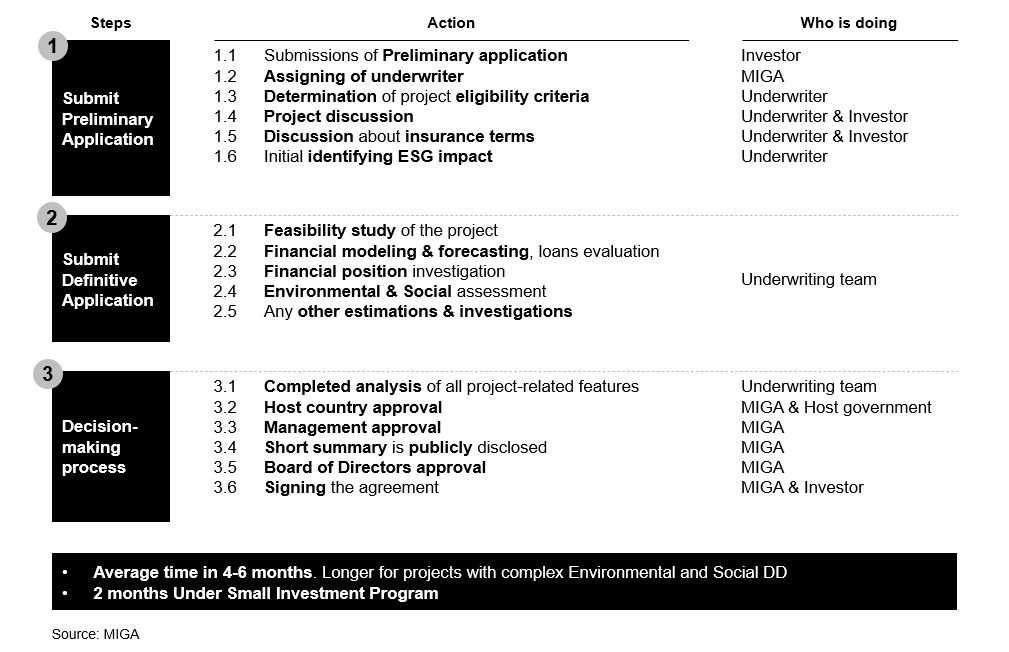

Every investor who wants to not only learn how MIGA Insurance works but also considers using it in his investment portfolio needs to understand the process of underwriting MIGA Insurance.

Let`s look closely at every step of it.

The process of issuing MIGA Insurance consists of three key steps.

The underwriting team processes the application in the following steps:

And the next question that you will be interested in is how long it takes to issue a MIGA Insurance guarantee.

We would like to advise you to estimate 4 to 6 months to complete all the abovementioned steps.

But here are two exceptions:

There are certain fees and financial issues concerning the whole process of MIGA's involvement in the project.

Firstly, there are three types of Underwriting fees:

Underwriting fees is the fee that you pay for your application to be reviewed, verified, and processed. This is a one-time payment, contrary to a premium that is paid regularly throughout the whole duration of a guarantee.

There are two types of Application Fee:

You have to pay the Application Fee when you are submitting a Definitive Application.

Application Fee is applied:

Processing Fee is an additional fee to cover assessment costs of complex projects which need supplementary research. This fee could cover the logistics costs of the underwriter visiting project facilities.

You have to pay the Processing Fee after MIGA processes your application and decides that it needs to dig deeper into the details to approve the guarantee.

Syndication Fee is applied in the case of syndicate insurance of the project. It is required to cover a project worth more than $250 m.

In this case, MIGA initiates syndicate creation for financing. This means that a few financial institutions accumulate a certain amount of money that is accessed to be sufficient to cover a project. So, the Syndication Fee is designed to cover certain expenses needed to create such a syndicate and other supplementary payments.

The next fee is the premium that is paid annually as a price for using insurance provided by MIGA.

The guaranteed premium is approximately 1% of the insured amount per annum. E.g., for a $20 m investment across 10 years, you would have to pay $2 m as a premium.

Guarantee premiums could vary due to the country or project risks.

MIGA issues a guarantee for a duration to:

Our best consulting advice will be to start preparing an application for MIGA Insurance with calculations of the profitability of such approximate expenses. So you will need to check if you can provide these fees for the project to start on time.

MIGA offers 5 different coverage products under which the agency may provide insurance up to $250 m.

If it is necessary to have larger insurance, the agency will arrange the syndication of insurance, as mentioned above.

Breach of contract in this case means that:

This product is applied when:

The guarantee under this product covers the decisions of:

This is an especially relevant product to the situation in Ukraine amidst the full-scale invasion of russia, which covers:

This product is used in case of defaults by bonds or loans of the sovereign, sub-sovereign, or state-owned entity

Therefore, if you want to apply for MIGA Guarantee, you need to check if your situation falls within the designated products. Otherwise, you risk receiving a rejection.

If you checked that your project falls within the products offered by MIGA and you have enough money to cover the fees, we offer you to verify if your project completes the general coverage criteria checklist.

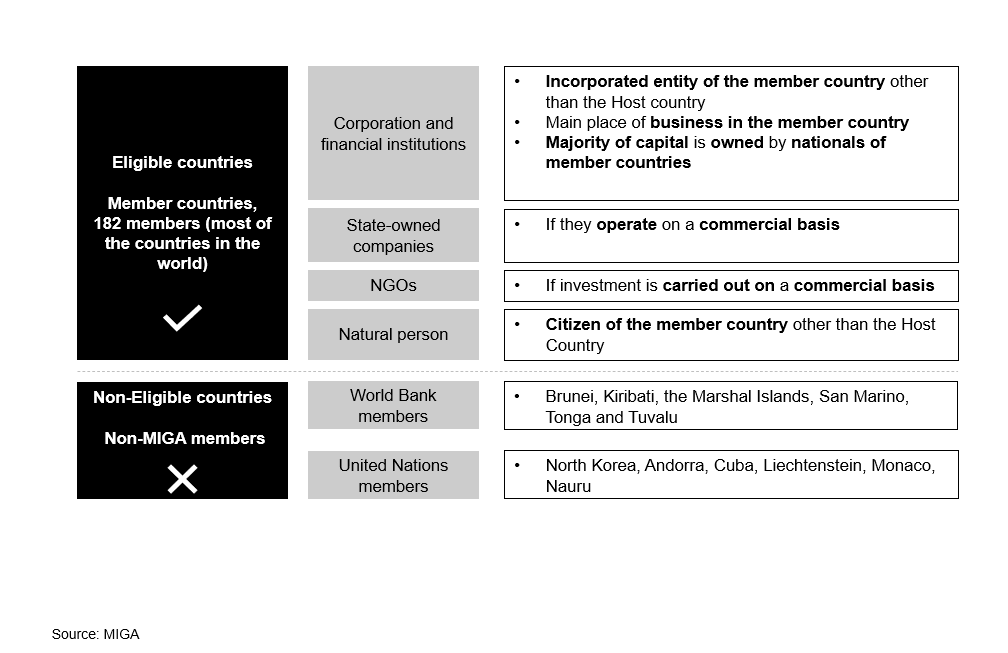

The first larger group includes applicants from 182 eligible countries that are members of MIGA countries.

To meet the criteria, you need to belong to a certain group.

All other countries are non-eligible to get insurance guarantees for the investments, either investor originated from these countries or investments would be provided into these countries.

The most well-known countries are divided into two bands:

1. World Bank members:

2. United Nations members:

So basically to qualify for MIGA Insurance, you need to meet both the country criteria and

belong to a specific investor type.

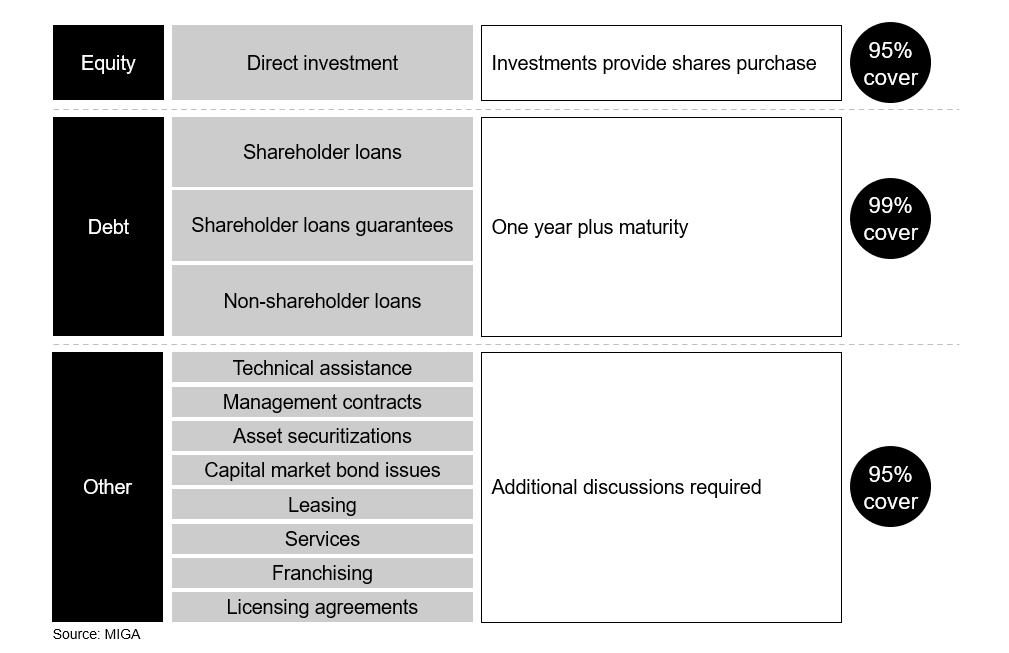

MIGA Insurance can cover three types of investments under certain provisions.

1. Applicants receive coverage of 99% of such debts with one year plus maturity (meaning they have to be issued for longer than a year):

2. 95% of direct investments are covered if they provide shares purchase

3. Applicants can receive coverage of 95% of the following clauses:

To verify the eligibility of the projects in the third group, MIGA requires additional discussions, so it is not 100% guaranteed that these clauses will receive coverage.

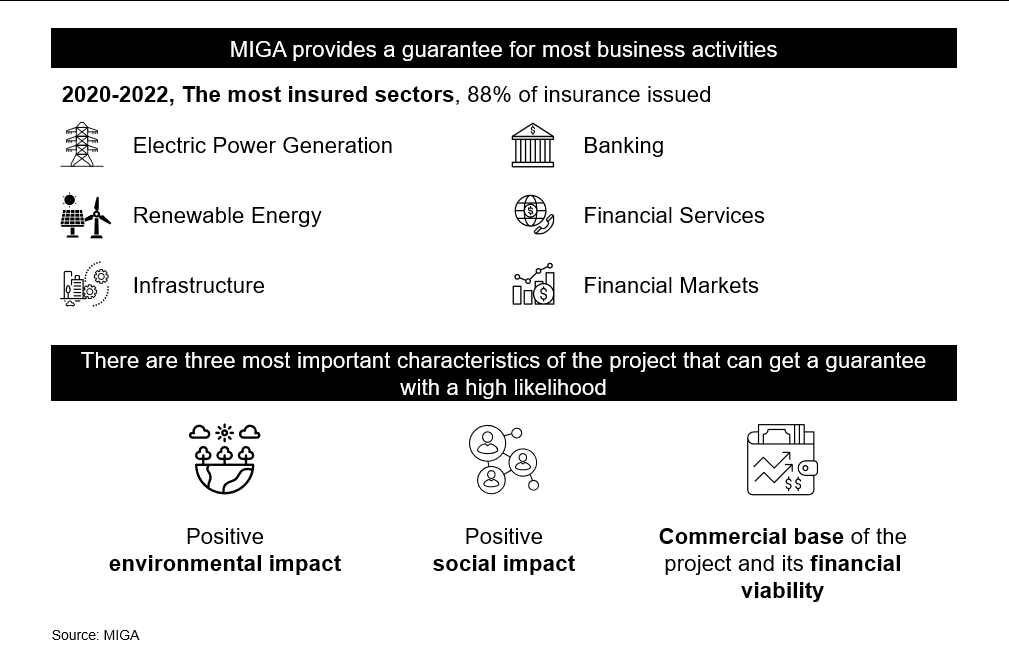

According to the latest studies, in 2020-2022, the most insured sectors with 88% of insurance issued are:

If you sum up the biggest projects and look for a pattern, you will find the three most important characteristics of the project that can get a guarantee with a high likelihood.

They are:

You can see the following features in a few recent projects, where MIGA provided a guarantee:

Certain features will prevent MIGA from reviewing your application if they find out during the investigation that you are involved in one of the following activities:

All the things we described above are routine staff and details. But someday, your insured event occurs. Of course, nobody wants it to happen, but this is why exactly you buy this insurance: to get coverage.

Therefore, you are interested in how this works today and whether it can apply to your project the way you want it.

There is a certain procedure that provides five steps to resolve a claim within the MIGA Insurance process.

MIGA should provide a decision about pay, denial, or other settlement of the claim no later than 180 days after receiving the complete Claim from the Guarantee holder.

So as we see, there can be 4 different ways where your claim can go:

The key task of MIGA in claims resolution is to solve them at the pre-claim procedure so that such disputes do not become full-grown claims at all.

So you need to prepare that your claim will highly unlikely be covered in full. Moreover, this confirms by the statistics: among 800+ MIGA projects, only 9 claims were covered.

And there were 110+ successful pre-claims solutions!

You need to understand that this means that 9 projects under war and civil disturbances or expropriation products received coverage (without having an opportunity for successful negotiations under such types of products). But for all other product types, MIGA managed to approve pre-claim solutions under negotiations with local governments and other stakeholders. MIGA is successful during negotiations during the pre-claim stage of issue resolution due to the World Bank entity status.

MIGA is an instrument that provides one of the options for reputation guarantees and ensuring investment safety in Ukraine. Each investor looking at potential investment projects in Ukraine considers MIGA as one of the essential points during the preparation thanks to its developed set of processes, accessible principles, and opportunities.

We are sure that MIGA Insurance secures a reputable function of the project and provides an investor with guarantees. Nevertheless, we cannot ignore the efficiency of receiving insurance claims.

This is a topic of our future guides and articles. We are collecting a complete cycle of tips to describe the whole process of applying for MIGA Insurance, underwriting the guarantees, and cases of supporting insurance claims.

If you are ready to proceed with an application for the MIGA guarantee, you can rely on support from Leopolis Group

Our team of national experts can:

We will make sure to:

If you have any questions, please get in touch with the Leopolis team: contact@leopolisgroup.com.

This research provides an overview of the military attacks on the electric plants that occurred over the century. Based on the historical perspective, it shows the mistakes done by different countries that challenged the resiliency of electric plants. Finally, based on the case of Ukraine in 2022, it describes what measures can be applied in order to ensure the resiliency of national electric grid.

Read MoreThis article provides a review of the nature of ESG. It includes the overview of ESG nature, its historical background, how it correlates with CSR, and various ESG regulations. Finally, in this article we will assess the importance of ESG and ESG ratings in the modern corporate world and what companies do in order to implement ESG practices.

Read More