This article focuses on the implication of business loyalty to terrorism to ESG ratings. Nowadays, many publicly traded companies still continue to operate in countries that sponsor terrorism. Furthermore, these companies also continue to receive the best ESG ratings as compared to their industry peers. In this research, we presented the list of publicly traded companies that made no official statement on leaving the Russian market and still hold the highest ESG ratings by MSCI and Sustainalytics – one of the most reputable ESG rating agencies in the world. We have presented the ratings methodology of these two agencies and its business ethics controversies.

In addition, the ninth package of sanctions against Russia was approved on December 15th. According to this package:

We conducted the research and found publicly traded companies incorporated in EU that made no official statement on leaving the Russian market.

This list comprises companies from different industries, such as automotive manufacturing, medicine, industrial engineering, and construction. All of the abovementioned companies have over 4,000 employees. The largest company by the number of employees among the list is Fresenius Medical Care, that employs over 125,000 workers.

There are several agencies in the world that are considered the most reputable when it comes to ESG ratings.

In this research, we only cover publicly traded companies, for this reason we decided to focus primarily on the ratings given by MSCI and Sustainalytics. These two agencies support investors with implementation of responsible investment strategies.

Many publicly traded companies that are incorporated in EU hold the highest ESG ratings by MSCI and Sustainalytics, despite the fact that the European Parliament has declared Russia to be s state sponsor of terrorism. High ESG ratings make these companies more attractive for international investors.

We have analyzed the ratings methodologies of MSCI and Sustainalytics and concluded several business ethics related concerns.

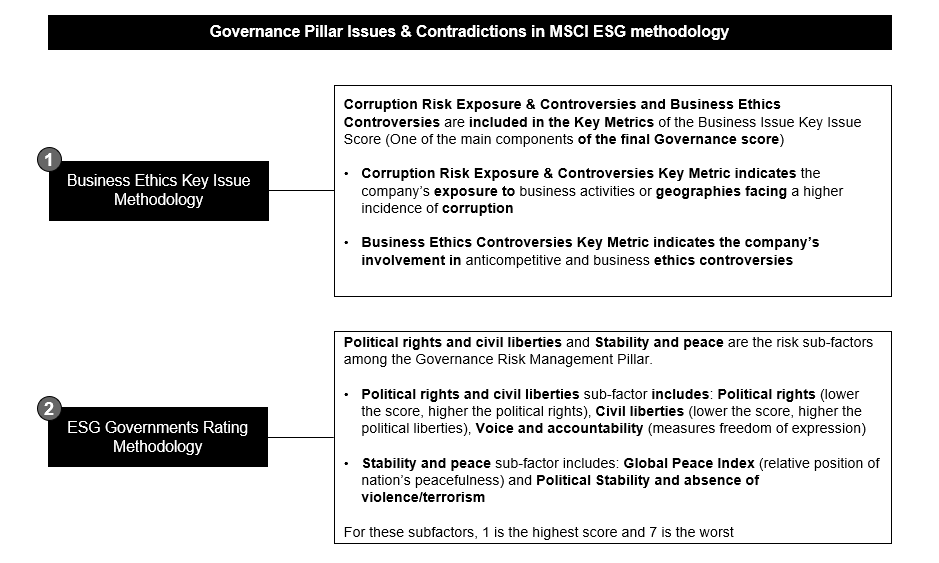

MSCI has an open policy regarding its ESG rating methodologies, they are publicly accessible and available to all users. Business ethics- and terrorism-related concerns are described in the G (Governance) component of the ESG rating.

We have reviewed the Key Metrics of the Business Issue Key Score, which is one of the main components of the final Governance score and found Corruption Risk Exposure & Controversies and Business Ethics Controversies metrics.

According to Transparency International, the global coalition against corruption, Russia’s Corruption Perceptions Index is 29 out of 100 in 2021. It indicates that Russia’s rank is 136 among 180 countries rated and its exposure to corruption is very high.

In the ESG Governments Rating Methodology, we have found Political rights and civil liberties and Stability and peace among the risk sub-factors in the Governance Risk Management Pillar. Political rights and civil liberties sub-factor includes Political rights, Civil liberties and Voice and accountability scores. Since the full-scale invasion of Ukraine, President Putin signed a law making the airing of what the government calls false information about the armed forces illegal. Journalists could be jailed for up to 15 years. Russian officials assert it's false to call their military operations in Ukraine a war or an invasion. This legislation appears to criminalize the process of independent journalism, and furthermore proves the absence of the freedom of speech in Russia.

Just as MSCI, Sustainalytics has always been open regarding its ESG Rating Methodologies.

In the Material ESG Issues (MEIs) Methodology, Bribery & Corruption, Business Ethics and Human Rights are defined as Key MEIs when calculating the ESG Final Risk Rating. Considering that the ESG Final Risk Rating is the weighted average score of E (Environmental), S (Social) and G (Governance) scores, the final rating should be lowered due to the Governance concerns in the companies continuing their operations in Russia.

Our team of national experts can provide you with strategy consulting, investment advisory, and organizational transformation support.

We analyze your business and investment opportunities, conduct commercial due diligence of your partners and target objects, evaluate potential risks, and assist your business in further development. Leopolis Group helps our clients in all aspects of their business, whether they are working in the domestic market or trying to expand abroad. We assist our clients with investing in and attracting investment to their businesses, as well as aiding them in launching projects with business partners and the government.

If you require any further assistance, please get in touch with the Leopolis team: contact@leopolisgroup.com.

This article provides an extensive guide about the policy of Multilateral Investment Guarantee Agency insurance (MIGA). It includes the detailed algorithm of issuing guarantees as a step-by-step process, the list of eligible countries, and resolution of claims. It also describes the latest projects covered by MIGA over the past 2 years.

Read MoreThis research provides an overview of the military attacks on the electric plants that occurred over the century. Based on the historical perspective, it shows the mistakes done by different countries that challenged the resiliency of electric plants. Finally, based on the case of Ukraine in 2022, it describes what measures can be applied in order to ensure the resiliency of national electric grid.

Read MoreThis article provides a review of the nature of ESG. It includes the overview of ESG nature, its historical background, how it correlates with CSR, and various ESG regulations. Finally, in this article we will assess the importance of ESG and ESG ratings in the modern corporate world and what companies do in order to implement ESG practices.

Read More