The banking sector in Ukraine has undergone significant changes over the past few decades. Since gaining independence in 1991, Ukraine has seen the transformation of its financial system to a market-oriented one. In 2005-2008, many leading international banking institutions entered the Ukrainian banking market boosting its development and quick growth.

In 2014, Russia started a war against Ukraine in the Eastern regions of the country and the Crimean peninsula. As a result, Ukrainian banks lost a significant portion of their assets in the occupied territories and had to accept such losses. Since then, more than 100 banks have left the market and the NPL rate jumped to a historical record of over 50%. The banking sector underwent huge losses in that time, but then started recovering in 2017-2021. In 2022, the banking business faced the new hit and unprecedented challenges of real wartime.

In this article, we will provide an overview of the banking sector in Ukraine and how it changed in 2022 since the full-scale invasion. We will analyze the current state of banking in Ukraine, and define its main challenges which should be addressed for further development of the sector.

With this article, readers will have a clear understanding of the Ukrainian banking sector, its key players, overall performance, issues, and challenges, as well as gain insights into the resiliency of the banking sector in Ukraine in 2022.

The Ukrainian banking sector is relatively not big with over $74 billion of total assets (~50% of GDP) held by 66 banks. 3 out of 4 state-owned banks (SOBs) are the biggest in terms of assets, while all four SOBs are on the list of TOP-5 banks and held 53% of the total assets at the end of 2022. At the same time, international banking groups are also present in the market - 22 banks are fully foreign-owned.

The banking sector’s total NPL ratio is 38.1%, with the largest share of non-performing loans found in state-owned banks with ~54% of their total assets.

The Ukrainian banking sector is capitalized well with a 19.7% of Capital Adequacy Ratio (i.e. CAR, calculated as banks’ capital divided by risk-weighted assets) at the end of 2022, which is well above the minimum requirement of 10% set by the regulator.

The number of banks decreased by 113 banks from 180 banks in 2013 to 67 in 2022, while the concentration of banks remains high. The biggest bank in terms of assets, state-owned PrivatBank, has 23.4% of net assets, while other TOP-5 and TOP-10 banks have over 58% and 78% of net assets in the banking sector, respectively.

Total deposits held by Ukrainian banks amount to almost $50 billion, of which SOBs held over 60%, while foreign banks and local privately-owned banks held ~22 and ~18% of customers' total deposits.

In conclusion, the TOP-3 challenges of the Ukrainian banking sector, along with wartime issues, are as follows:

In terms of assets, the TOP-20 banks in the Ukrainian banking sector represent ~93% of the market or ~$69 billion and include the following banks in descending order: PrivatBank, Oschadbank, Ukreximbank, Raiffeisen Bank, Ukrgazbank, PUMB, UkrSibbank, OTP Bank, Sense Bank (former Alfa-Bank Ukraine), Universal Bank (host bank for “monobank”, a local popular Fintech/neobank project), Credit Agricole, Citibank, Pivdennyi Bank, KredoBank, ProCredit Bank, TAS Bank, Credyt Dnipro, A-Bank, Vostok and ING.

In terms of customer deposits, the TOP-20 banks in the Ukrainian banking sector held ~$46 billion and include the same institutions above in almost similar order.

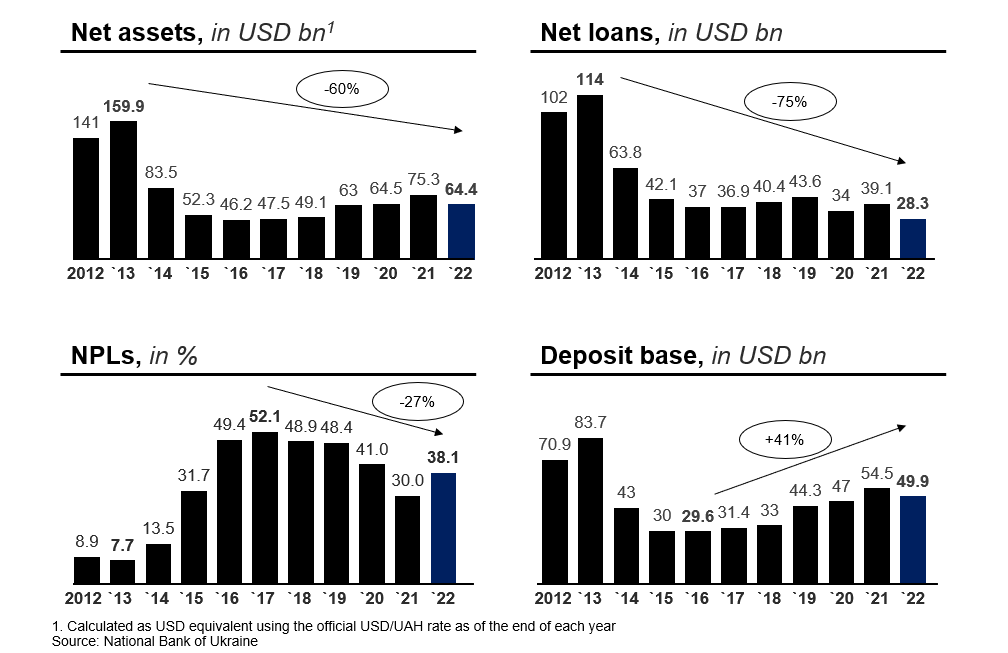

The Ukrainian banking sector suffers from the poor quality of assets and the limited funding base of customer deposits. The amount of net assets considerably fluctuated over the past 10 years - since the peak in 2013 at almost $160 billion, the net assets then decreased to $46 billion in 2016 due to local currency devaluation and banking sector treatment as a result of Russian aggression, occupation of Crimea, and some regions of Donbas. Then, the net assets were restored to $75 billion in 2021 and declined again to $64 billion due to the full-scale invasion and recurring local currency devaluation. The amount of net loans peaked in 2013 at $114 billion and since then has decreased to $28 billion in 2022.

Over the past 10 years, the NPL ratio jumped from 7.7% in 2013 to 52.1% in 2017 - the top level ever - and declined by almost twice to 27.2% in 2021. Due to the full-scale invasion in 2022, the NPL ratio increased to 38.1% at the year-end, but as compared to the previous years, it is still drawing a decreasing pattern from 2017 onwards.

The amount of both corporate and retail deposits in banks reached its peak in 2013, while it was the lowest in 2016. From 2016 onwards, the deposit base has an increasing increasing pattern for the Ukrainian banking sector.

Banking infrastructure kept hit of the wartime year and coped well with the challenges. Due to the full-scale invasion, the number of active banking outlets in Ukraine in 2022 decreased by 20% as compared to the previous year, from ~6700 to ~5300. The number of active ATMs decreased as well, hence it was decreasing each year from 2019 onwards. Additionally, the number of active POSs was increasing till 2021 to 439 thousand units, whilst it decreased by 16% in 2022 as compared to the previous year to 368 thousand units. However, the number of active bank cards remained the same, 46.3 million cards in 2022 and 2021, rising by 15% since 2020, when the global pandemic hit the world.

Net assets of the Ukrainian banking sector are imbalanced. More than 40% of net assets of the Ukrainian banking sector are in the central bank (incl. deposit certificates and National Bank of Ukraine accounts), and cash. Loans to customers take less than a third of all net assets (28%), with retail loans of just 5.7% of the net assets structure. However, banks are big investors in T-bonds with almost 22% of net assets in government securities.

Customer deposits are the main funding base with 88% of liabilities, however, 79% of all deposits went to fund government bonds, central bank instruments, and cash. The remaining 12% of liabilities are interbank operations, money from IFIs and the National bank of Ukraine, and others.

The non-performing loans present a significant challenge for Ukrainian banking with 38.1% of the total NPL ratio in 2022, which is lower than in 2020 (41%), but higher than in 2021 (30%) due to the asset base decrease. The NPL ratio in the Ukrainian banking sector was higher among corporate loans (42.9%) as compared to retail loans NPL (30.4%) in 2022.

State-owned banks are the main holders of non-performing loans, with 84% of all NPLs, and have the highest NPL ratio of 53.7%. Among the state-owned banks, PrivatBank, the TOP-1 bank in Ukraine by the number of assets and liabilities, has the highest NPL ratio of 69.2%, and NPLs amount to 41% of all NPLs in the banking sector.

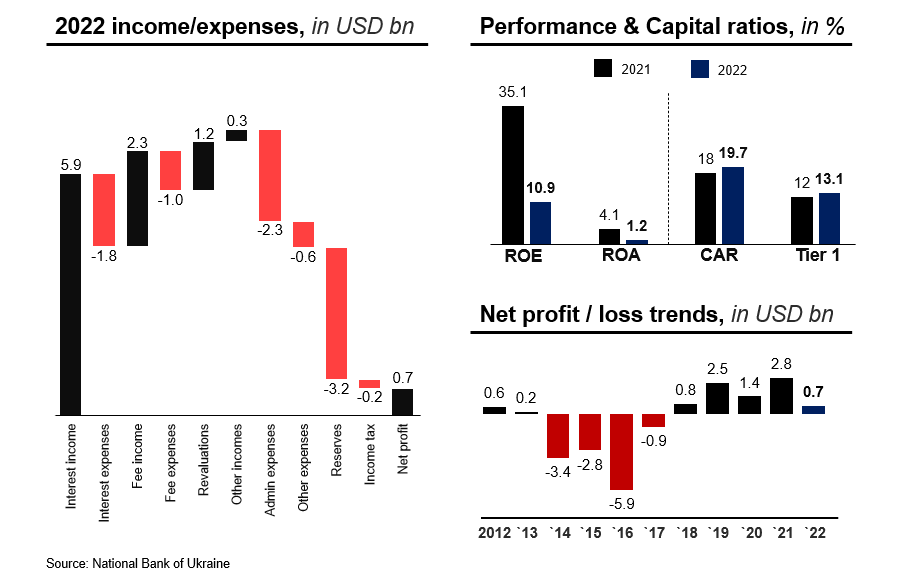

The Ukrainian banking sector was overall profitable in 2022 with $0.7 billion of net profit, down from $2.8 billion in 2021. The dynamics of the profitability show that despite the start of the Russian aggression in 2014 and the full-scale invasion in 2022, the Ukrainian banking sector incurred the highest losses in 2016. This happened due to the formation of reserves for NPLs and acceptance of losses from the temporarily occupied territories.

At the same time, the Ukrainian banking sector was well capitalized in 2022 with 19.7% of the Capital Adequacy Ratio, up from 18% in 2021, which is well above the minimum requirement of no less than 10% set by the regulator.

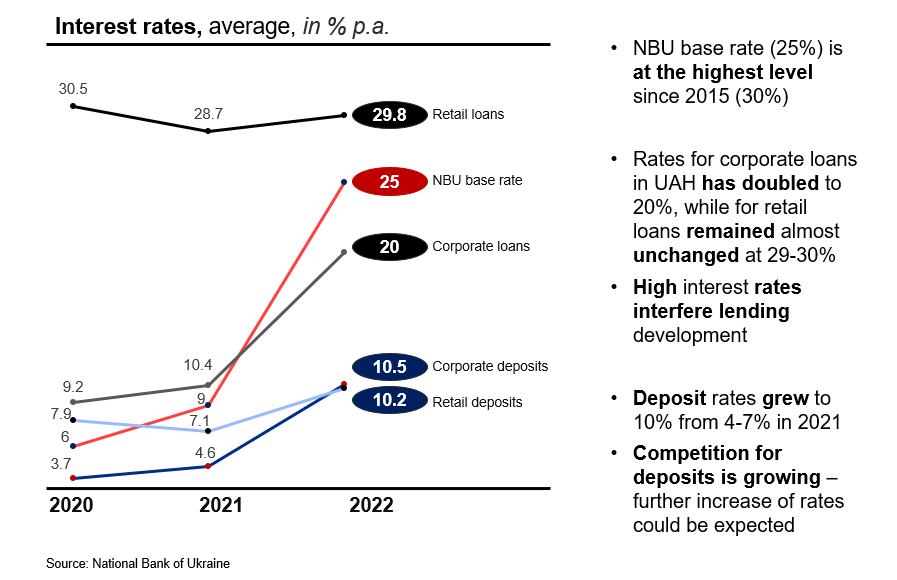

In 2022, interest rates have substantially increased in the market. The key policy rate of the National Bank of Ukraine was hiked to 25% per annum, up from 9% and 6% as compared to 2021 and 2020 respectively, as the central bank is fighting high inflation rates. The current policy rate of 25% is actually at the highest level since 2015 when it peaked at 30%.

Rates for corporate loans in local currency have doubled to 20%, while for retail loans remained almost unchanged at around 29-30%. Deposit rates grew to 10% in 2022 from 4-7% in 2021. High interest rates interfere lending development, while competition for deposits is growing, meaning that further increase of rates could be expected.

The Ukrainian banking sector has undergone significant changes in the past few decades, and at the same time has demonstrated its resilience and ability to adapt to major world-changing circumstances.

The sector still faces challenges with the low quality of assets and high NPL ratio with state-owned banks holding the majority of non-performing loans, and a limited funding base supported mainly by customer deposits. The concentration in the small and distressed Ukrainian financial market is rather high, with 4 state-owned banks forming the group of largest players in the sector. Interest rates have substantially increased in 2022, and such a high cost of funding interferes with lending operations and cannot support economic recovery actively.

Despite all the challenging conditions in the market, the Ukrainian banking sector is profitable and well-capitalized, and it has proven to be resilient and adaptable with most banks finding ways to continue operating and serving their customers. While the number of active banking outlets, ATMs, and POSs has decreased in 2022, the number of active bank cards has remained the same at the highest-ever levels, meaning that people continue actively using their bank accounts and cards as the remote banking services have proved their stable work.

If you have any questions or want to discover more interesting insights about the banking industry in Ukraine, please get in touch with the Leopolis team: contact@leopolisgroup.com.

Since many Ukrainian businesses have been forced to move their headquarters further away from the regions that suffer from military operations due to the full-scale invasion launched in February 2022, international donors offer their financial aid. This review includes the full list of donors offering help to Ukrainian businesses by sectors.

Read MoreThis article focuses on the implication of business loyalty to terrorism to ESG ratings. Nowadays, many publicly traded companies still continue to operate in countries that sponsor terrorism. In this research, we presented the list of publicly traded companies that made no official statement on leaving the Russian market and still hold the highest ESG ratings the most reputable ESG rating agencies in the world.

Read MoreThis article provides an extensive guide about the policy of Multilateral Investment Guarantee Agency insurance (MIGA). It includes the detailed algorithm of issuing guarantees as a step-by-step process, the list of eligible countries, and resolution of claims. It also describes the latest projects covered by MIGA over the past 2 years.

Read More