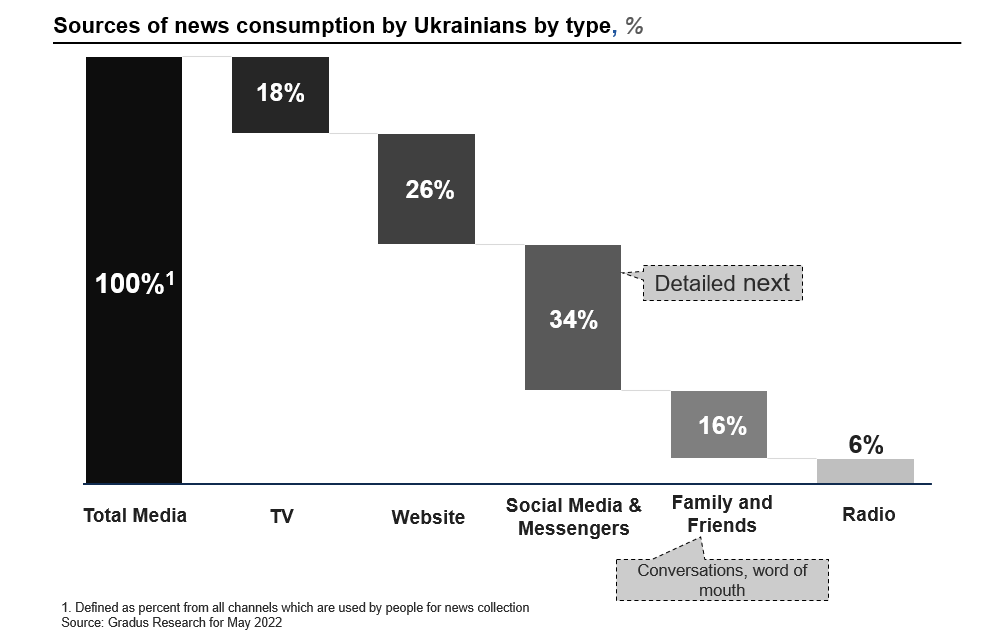

In today's digital age, people are increasingly turning to social media and messaging apps as their primary sources of news and information, and the current situation in the Ukrainian media market is no exception. Over half of the country's population uses social media, messengers, and websites as the for news collection, while even less than 20% of Ukrainians consume news through traditional broadcast television.

Instead, a majority of Ukrainians rely on social media platforms such as Facebook, Twitter, and Instagram, as well as messaging apps like WhatsApp, Viber, and Telegram, to stay informed about current events. This shift towards digital news consumption is driven by a number of factors, including the convenience and immediacy of online news sources, as well as a growing distrust of traditional media outlets.

Unlike many other countries where social media usage is dominated by a single platform, there is no clear winner in Ukraine. Instead, the distribution of users among different platforms is relatively even, with YouTube, Viber, Instagram, Telegram, Facebook, and TikTok all having a significant presence. The only exception in the case of Ukrainian social media market is Twitter that has a low share of registered users as compared to other platforms.

Facebook remains one of the most popular social media platforms in Ukraine, with nearly a third of Ukrainians registered, as of 2022.

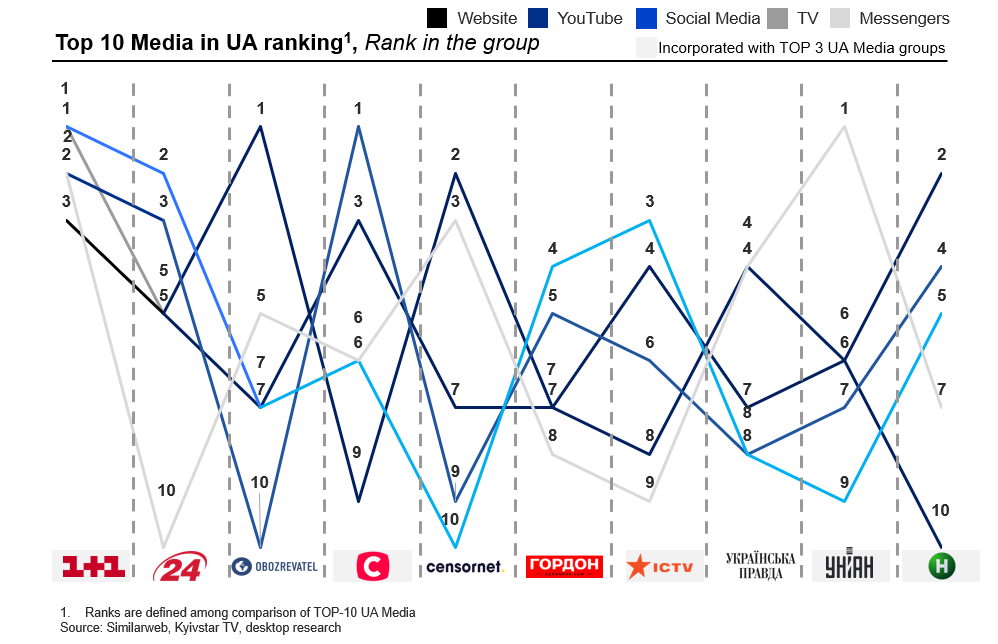

Of the top 20 media in Ukraine, six of them are part of the three leading media holdings in the country. These three holdings are 1+1 Media, Starlight Media, and Inter Media Group, which collectively own several television channels, radio stations, and online news outlets. While these media holdings have a significant influence on the Ukrainian media market, they do not have a monopoly on information spread. The Ukrainian media landscape is characterized by a diverse ownership structure, with numerous independent entities operating alongside those owned by media holdings. This diversified ownership structure ensures that no single entity has a key control on information spread in the country, promoting competition among media outlets to provide news to the public. Despite this, the Ukrainian media market remains subject to various challenges, including pressure from political forces and threats to journalists' safety, which can limit the scope of media freedom and independence in the country.

The top 10 media outlets in Ukraine have a diverse mix of platforms, including television channels, websites, social media platforms, and messenger apps. While each media outlet has a different primary source, most of them have a presence across multiple niches. For example, the television channel 1+1 has a significant presence on social media platforms and operates a popular news website, while the online outlet Ukrayinska Pravda is also active on messenger apps such as Telegram. Despite this overlap, there are distinct differences in the rankings of these media outlets across different niches. For instance, while the TV channel Novy has a significant viewership, it ranks lower on social media platforms compared to other outlets. This diversity of media outlets and their varying rankings show that each platform must adapt and compete across multiple niches to maintain its relevance and audience.

The full-scale Russian invasion and the start of the war in Ukraine in 2022 had a significant impact on the country's advertising market. According to industry reports, the total Ukrainian advertising market dropped by 63% in the year following the outbreak of the war. Digital advertising was particularly affected, with spending dropping from USD 321 million to USD 180 million, a decrease of 44%. Similarly, television advertising spending dropped from USD 341 million to USD 65 million, a decrease of 81%. These sharp declines in advertising spending had a ripple effect on the media industry in Ukraine, increasing the dependence of media outlets on their owners for financial support. In some cases, media outlets were forced to suspend operations or reduce staff due to the economic pressures caused by the war.

If you have any questions or want to have full research with annexes, please get in touch with the Leopolis team: contact@leopolisgroup.com.

Since many Ukrainian businesses have been forced to move their headquarters further away from the regions that suffer from military operations due to the full-scale invasion launched in February 2022, international donors offer their financial aid. This review includes the full list of donors offering help to Ukrainian businesses by sectors.

Read MoreThis article focuses on the implication of business loyalty to terrorism to ESG ratings. Nowadays, many publicly traded companies still continue to operate in countries that sponsor terrorism. In this research, we presented the list of publicly traded companies that made no official statement on leaving the Russian market and still hold the highest ESG ratings the most reputable ESG rating agencies in the world.

Read MoreThis article provides an extensive guide about the policy of Multilateral Investment Guarantee Agency insurance (MIGA). It includes the detailed algorithm of issuing guarantees as a step-by-step process, the list of eligible countries, and resolution of claims. It also describes the latest projects covered by MIGA over the past 2 years.

Read More